South Gloucestershire Council’s (SGC’s) element of the council tax levied on local households is to increase by 4.99 percent from April 2023.

The latest rise follows an uplift of 2.99 percent in 2022/23 and 4.99 percent in 2021/22, both of which included ring-fenced levies (1 percent in 2022/23 and 3 percent in 2021/22) to support adult social care.

The 2023/24 increase once again includes a social care levy, this time 2 percent.

Both component increases (2.99 percent in ‘base’ council tax and 2 percent in adult social care levy) are the maximum allowed by central government for the coming financial year without holding a local referendum.

The increase means that the South Gloucestershire Council element of council tax for a Band D property for 2023/24 will rise to £1,752.11.

A council spokesperson said:

“The council has approved spending plans for the coming year, which include more than £287 million on day-to-day services; more than £132 million on capital projects and infrastructure schemes; and which allocates more than £267 million to schools, skills and early learning.”

“Balancing the budget has been a major challenge due to the impact of the cost-of-living crisis, which has driven up what the council needs to pay to deliver services, at the same time as demand for those services continues to grow rapidly.”

“The council has been able to balance its spending plans and, while savings will impact some activities, council tax will rise below inflation and the most vital frontline services have been protected. It has also been able to invest in priority areas to meet community needs.”

Key investments include:

- More than £37 million to help deliver the new primary and secondary schools in Lyde Green, for which delivery plans are expected to be approved in the coming months

- More than £14 million on the improvement programme for the Castle School Education Trust schools in Thornbury: Castle and Marlwood

- £3 million to increase the provision of new homes for children in care, to help them stay close to their local communities

Funding delivered by the council directly to local schools will increase by £15.2 million (8.1 percent) and local spending on the High Needs Block, which supports children with additional needs, will rise by £5.2 million (11.5 percent). More than £267 million will be spent by schools and to support early years settings and post-16 learning in South Gloucestershire, with minimum per-pupil funding of at least £4,405 for each primary school and £5,715 for secondary school child.

The council will also make changes to some services in order to reduce its costs by more than £24 million, while also increasing income through fees and charges for eligible services.

Cllr Toby Savage, leader of the council, said:

“These are tough financial times for the council, as they are for all our residents and businesses. But I am pleased that we are able to set a budget that builds on our hard work in previous years and which continues to deliver on our priorities for residents and businesses across South Gloucestershire.”

“The council will continue to invest tens of millions of pounds in local schools to ensure record attainment levels continue and take decisive action to tackle the climate crisis. We will build vital public transport infrastructure and invest in local high streets to ensure that our significant achievements over the past few years continue.”

Breakdown of charges

In addition to the South Gloucestershire element, bills that will be coming through letterboxes in the next few days will include contributions to Avon and Somerset Police (up 5.97 percent, on top of a 4.15 percent hike last year and 5.88 percent the year before) and Avon Fire & Rescue Service (up 6.41 percent), and the precept raised by Bradley Stoke Town Council (no increase this year), producing a grand total of £2,218.27 for a Band D property, an increase of 4.96 percent over last year.

Bradley Stoke

Stoke Gifford

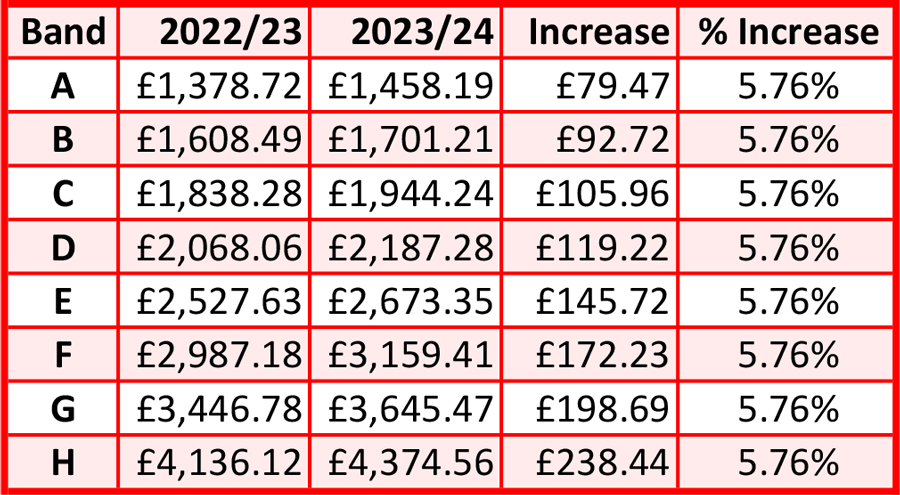

Percentage increases for the SGC, police and fire service elements of the tax are as for Bradley Stoke. However, the different level of parish precept in Stoke Gifford (up 2.7 percent this year) results in a grand total of £2,187.28 for a Band D property, an increase of 5.76 percent over last year.

Note: Different charges will apply in Stoke Park and Cheswick, which will separate from Stoke Gifford and form a new parish after the local elections on 4th May 2023.

More information about spending plans and the council tax setting process, along with a detailed explanation of how the figures are calculated, can be found in reports presented to the Meeting of Council on 15th February 2023.

More information and related links:

- Summary of 2023/24 council tax for charges for all parishes in South Gloucestershire (SGC) [PDF; 57kB]

- Council tax explained – where your money goes (SGC)

Editor’s note: The precept raised by Avon Fire & Rescue Service is subject to final confirmation at a meeting on 16th February 2023.